The Best Strategy To Use For Virtual Terminal

Wiki Article

Indicators on Clover Go You Need To Know

Table of ContentsSome Of Square Credit Card ProcessingThe Best Guide To Fintwist SolutionsThe smart Trick of Square Credit Card Processing That Nobody is DiscussingA Biased View of Payeezy GatewayAn Unbiased View of Comdata Payment SolutionsHow Credit Card Processing can Save You Time, Stress, and Money.Facts About Online Payment Solutions RevealedSome Ideas on First Data Merchant Services You Should KnowAll about Merchant Services

The B2B repayments area is rather crowded. A number of banks, fintech companies, as well as sector experts supply B2B repayments platforms, and also brand-new business are entering the area often. We took a look at the choices, and also here are a few of the very best B2B payment solutions: Ideal for: B2B businesses that purchase or market on web terms.9% handling fee (similar to what Pay, Pal as well as Square charge for credit card payments). There's likewise checkout functionality with Fundbox Pay.

The Facts About Payment Hub Uncovered

Fundbox Pay's B2B solutions essentially shift the danger of the customer not paying far from the seller. This is similar to making use of credit rating cards in the consumer area. When a person goes to a restaurant or purchases a film ticket with a charge card, the seller earns money right away, and also the customer defers settlement for a billing cycle.

Excitement About Virtual Terminal

Pay, Pal is a heavyweight in the B2B repayments industry. All they have to do is click the "pay" button, and also they can pay with their Pay, Pal balance, a connected financial institution account, or a credit report or debit card.

Getting The Payment Hub To Work

Quick, Books additionally offers a B2B settlement service that works in a similar way to Square and Pay, Buddy.Best for: B2B customers that desire to streamline settlements with a credit scores card. One factor that handling B2B settlements is challenging is that different vendors like various payment techniques.

The 10-Minute Rule for Credit Card Processing

Profession, Gecko is a supply and order administration company, but additionally uses robust B2B payments solutions. They likewise provide a settlement entrance for wholesale buyers.

The Facts About Virtual Terminal Uncovered

Whichever B2B repayment option you select, a lot of little organization owners discover themselves on the paying end and also receiving end. Below are some finest methods when you're the customer: Clear your accounts payable equilibrium by paying not long after explanation the deal. Utilize a bank card to pay if you require even more time to resolve the expense.Utilize your positive payment background to discuss positive terms with brand-new suppliers (virtual terminal). Below are some ideal methods when you're the vendor: Send an invoice or payment request right after the purchase. Adhere to up with pleasant tips as the repayment due date nears. Impose due days and late costs to guarantee your clients pay on time.

9 Easy Facts About Fintwist Solutions Described

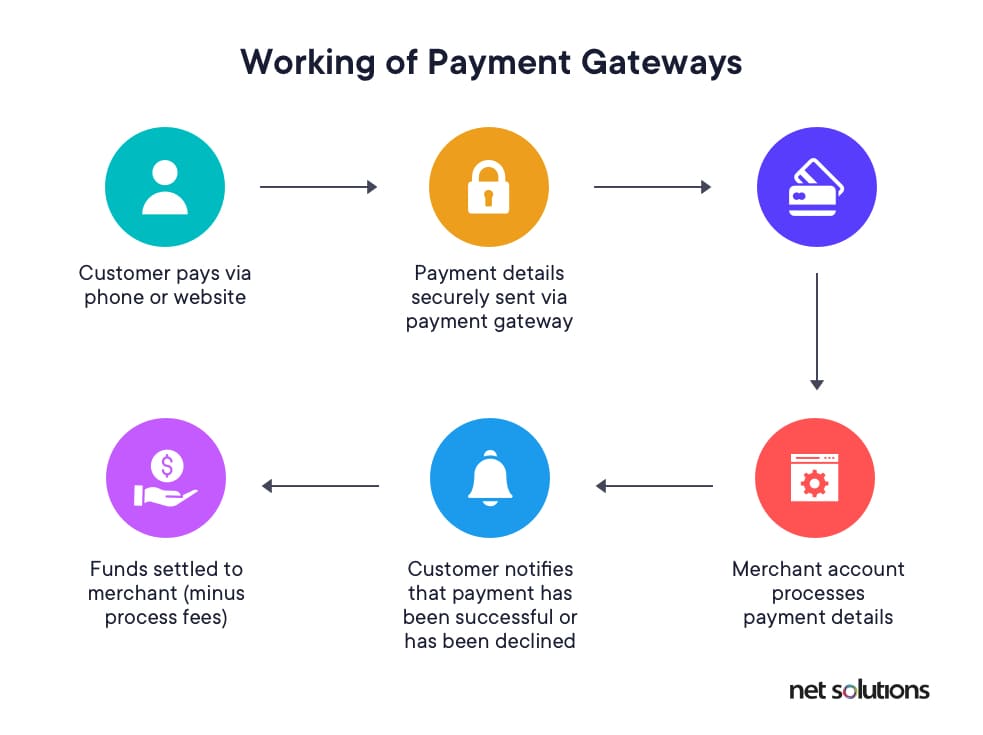

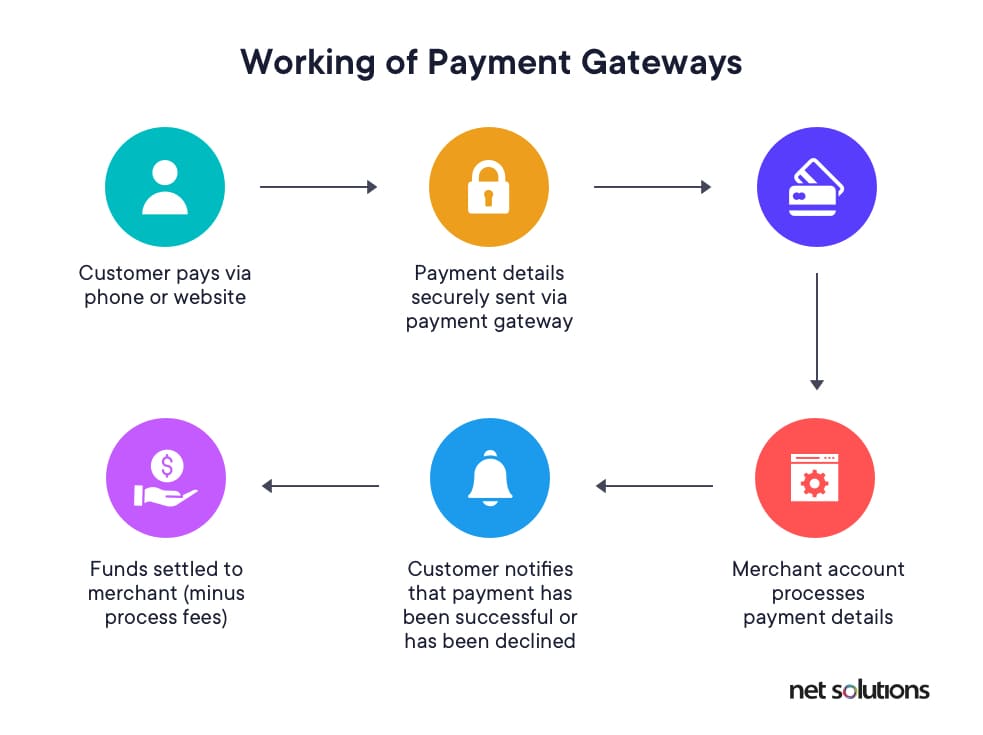

What do why not look here settlement processing firms imply when they claim "payment pile?"Merely placed, a payment stack is all the components needed to produce an on the internet payment remedy.What are the Components of a Payment Heap? Over the last decade, repayment technology has advanced past simply allowing vendors to process charge card. The durable collection of innovations and capacities that collaborate to produce contemporary fintech solutions are commonly referred to as "the settlement stack."The term "repayment pile' is used to describe all the modern technologies as well as parts that a firm utilizes to approve payments from consumers.

The Ultimate Guide To First Data Merchant Services

These are some of the elements of a payment stack that job with each other to develop a frictionless commerce experience for businesses, banks and clients. Fraud Prevention, As modern technology continues to progress, deceptive activity continues to evolve. It needs to come as no shock that sellers as well as other services are experiencing even more information violations than in the past.It's finest to keep a record of every purchase within the company by making use of bookkeeping software, yet also outside of the firm. This is done by checking documents with the financial institutions that tape the purchases. If an error is made, just straighten your business's documents best credit card processing with financial institution declarations to find the source of an error.

Examine This Report on Merchant Services

Checkout User interface, A good check out interface makes it very easy for clients to see pricing in their local currencies and to find as well as utilize their preferred local payment techniques. The check out user interface is a critical element of your web site experience as well as vital for making certain you don't lose consumers that intend to purchase from you.Report this wiki page